Find out what's included in a promissory note, how to write one, and download a free template. Includes frequently asked questions.

Updated on September 19th, 2023

A promissory note is a document written by a borrower to a lender. The note acts as a formal promise to pay whatever funds are owed, either on-demand or by a specified date. Promissory notes may be used when businesses borrow money from private/alternative lenders or even financial institutions in some cases.

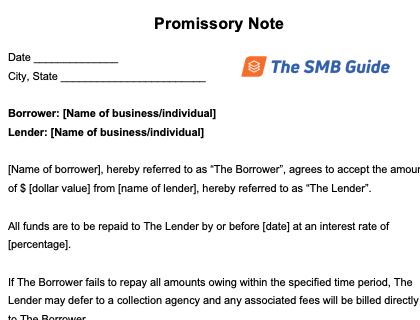

Use our promissory note template in Microsoft Word to create your own customized note.

Download Now Instant download. No email required.

A secured promissory note is one that comes with collateral for the lender to hold until their money is paid back. The lender may specify what collateral will be acceptable.

An unsecured promissory note is a promissory note that is written without any collateral. Unsecured notes may be used with small sums of money where there is less risk of the borrower defaulting.

A promissory note is a legally binding document, just like a contract. It can be upheld in a court of law if both parties have signed the note.

Your note should include the names of both parties, signatures, the amount of money being loaned, and the terms of repayment.

Yes, a promissory note is negotiable in the sense that its ownership can be transferred. Thus, the original lender may be able to sell it to another party and transfer their ownership, meaning that the new party has the right to debt.

Yes. A promissory signed note is legally binding, just like a contract.

As long as the note is signed by both parties, it is considered to be a legal document, even if it is handwritten.

Promissory notes are subject to the statute of limitations in whatever State they are written. The statute ranges from 3 years to 15 years. Check your State's laws regarding promissory notes for more information.

A promissory note can be issued by either an individual or a corporation. If a corporation issues a promissory note, it will accept all liability associated with the debt.

In some cases, banks may accept promissory notes as a means of helping you to qualify for a mortgage or loan. However, you can't "cash in" your promissory note at a bank.

A check can be deposited directly into your bank account, while the money from a promissory note can only be obtained directly from the debtor.

In order for a promissory note to be legal, both parties must sign it. The signatures show that both parties have consented to the terms of the note.

You can draft a promissory note for yourself at no cost, but it is advisable to hire a lawyer who can draft and review the document for you. The cost of this will depend on your lawyer's hourly fees.

Keep the original note, and once the borrower has paid back their loan in full, mark "paid in full" on the note. Sign the note to verify that it has been paid, and return it to the borrower.

© 2024 The SMB Guide Inc, 20 W Kinzie St Chicago IL 60610